Stochastic Oscillator Settings For Day Trading

How do stochastic oscillator's work? At the same time, the user can always customize them, assess the work of the indicator historically with different settings and pick up those that suit their trading best.

Stochastic Oscillator 21, 8, 8, Binary System Forex

Stochastic Oscillator 21, 8, 8, Binary System Forex

This strategy provides you with several trading opportunities every day.

Stochastic oscillator settings for day trading. Same rules apply for day trading also, just like we discussed for swing trading. We’re day trading, but having in mind the higher time frame sentiment and trend. That’s why this image below will explain better (using an 8 period stochastic)… stochastic indicator settings.

A stochastic oscillator is a momentum indicator comparing the closing price of a security to its price range over a specific period of time. For example, if a stock opened at $10, traded as low as $9.75 and as high as $10.75, then closed at $10.50 for the day, the price action or range would be between $9.75 (the low of the day) and. The speed of a stochastic oscillator refers to the settings used for the %d and %k inputs.

If that is your entry/exit trigger, you are exiting a trade before it goes onto make highs. If you want to scalp or to day trade only with this indicator, it will be a very hard task to find valid signals. Trading in the direction of the bigger trend improves the odds.

For swing traders finding opportunities among hundreds of stocks, this is a huge advantage. L14 is the lowest price when looking back at the 14 previous trading sessions; Basic awesome oscillator trading strategies.

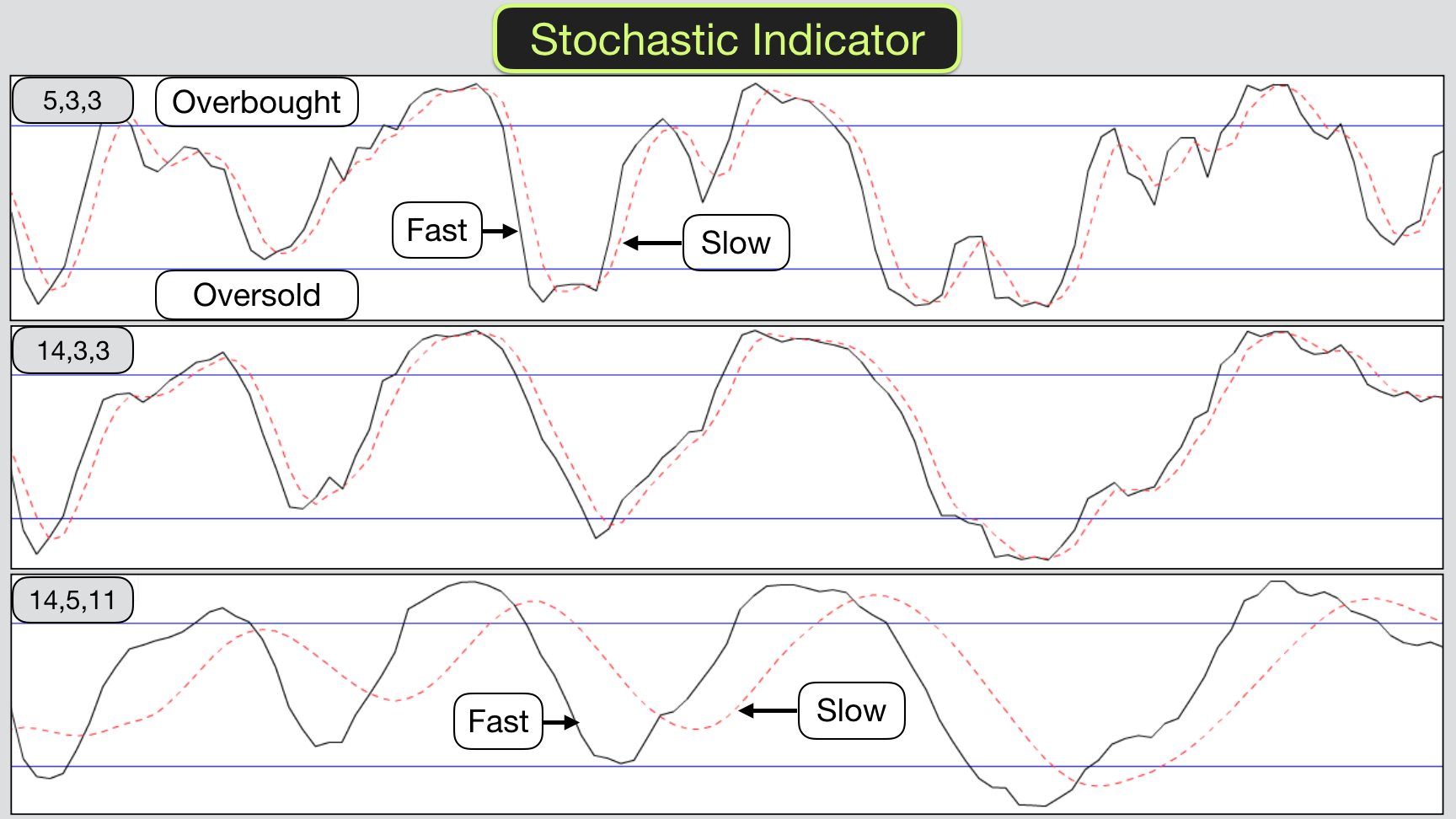

1 2 next > rc5781. Stochastic oscillator comes with the standard 5.3.3 settings. Find the complete trading set up outlined below.

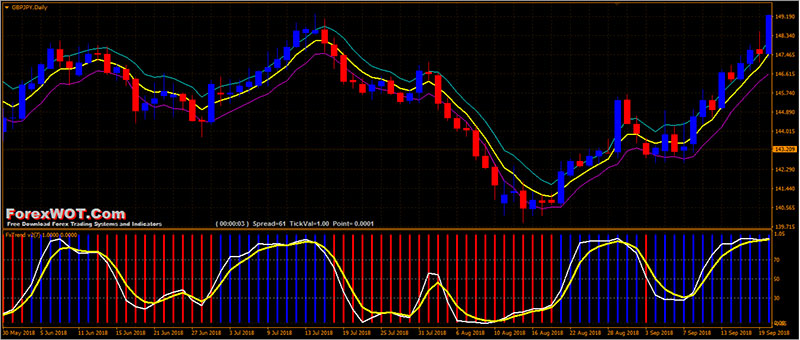

Stochastic settings for day trading. Stochastic oscillator with default settings, fisher.ex4 preferred time frame(s): Best stochastic settings for day trading.

Any suggestions on stochastic settings best suited for this? Below we’re going to give you some of the best stochastic oscillator settings that you can apply on your trading. I looked at the stochastic oscillator and price action to decipher the trend to avoid adding indicators.

Now that we are all grounded on the awesome oscillator, let’s briefly cover the 4 most common awesome oscillator strategies for day trading. This is all multiplied by 100 to normalise the figure. That was exactly what has made me a master stochastic trader.

Once, a day or swing trader gets it, he or she will find the best stochastic oscillator settings. Unlike other oscillators, it does not follow price or volume, but the speed and momentum of the market. The stochastic oscillator is a momentum indicator, which compares the most recent closing price relative to the previous trading range over a certain period of time.

Please feel free to experiment with the different settings. The stochastic oscillator is a momentum indicator comparing the closing price of a security to the range of its prices over a certain period of time. The stochastic oscillator is frequently used with the default settings.

Now there’s nothing magical about it. By itself, the stochrsi is not a reliable indicator. We’re looking for a modest 10 pips price objective.

Stochastic oscillator is an indicator that is widely used by the professional trader to understand market volatility. This article used the standard stochastic oscillator settings to show ways to trade with it. The settings on my stochastic indicator is (20, 1, 1) and it’ll show a single line instead of the traditional 2 lines.

If you don’t understand the risk, you don’t know the reward. As you can see in on the charts above, the fast stochastic oscillator can be fairly volatile, often trading above or below the 80 and 20 levels for a short period of time. Hence, they are easy to code into market scanning software.

The stochastic settings which can be best for swing trading : H14 is the highest price when looking back at the 14 previous trading sessions Is a technical analysis indicator created by applying the stochastic oscillator.

Now, depending on your trading style, you have to decide how much noise you’re willing to accept with the stochastic. The full stochastic oscillator (20,5,5) was used to identify oversold readings. Other common settings are 8.3.3 and even 14.3.3.

Now just a quick one. You can see the 5.3 stochastic setting on this one minute chart of crude oil reacts quicker to price and in some instances, crosses to the downside. The stochastic oscillator was developed by george c lane in the late 1950s.

Check the daily chart and make sure the stochastic indicator is below the 20 line and the %k line crossed above the %d line. On the same chart, you can see areas where the %d (sma figure) is not as volatile and does not always dip below or move above the 80 or 20 levels like the fast stochastic. The full stochastic oscillator moved below 20 in early september and early november.

As you will see in this quick primer on stochastics settings and interpretation. It is one of the earliest technical oscillators in securities trading used to predict future market direction. Day trading with the best stochastic trading strategy (rules for a buy trade) step #1:

The result obtained from applying the formula above is known as the fast stochastic. If you use this strategy by itself, you will lose money. Overbought readings were ignored because the bigger trend was up.

Both of them matter in the end. In trading, this is more important than any trade setup. Discussion in 'technical analysis' started by rc5781, nov 9, 2007.

How to use stochrsi for scalping/day trading. However, the best stochastic settings for day trading are the ones that consider risk management. Scalping may seem easy, but the reality is that it’s an advanced trading style.

You can use stochastic settings for day trading also. It requires very quick decision making, quick reflexes to react when setups.

Stochastic oscillator settings forex and also

Stochastic oscillator settings forex and also

Best Forex Stochastic Oscillator Strategy In 2021

Best Forex Stochastic Oscillator Strategy In 2021

Stochastic Oscillator Trading Indicator

Stochastic Oscillator Trading Indicator

Stochastic Oscillator Trade Platform

Stochastic Oscillator Trade Platform

Stochastic Oscillator Day Trading Terminology Warrior

Stochastic Oscillator Day Trading Terminology Warrior

Tutorial for learn trading with Stochastic Oscillator

Tutorial for learn trading with Stochastic Oscillator

Best Forex Stochastic Oscillator Strategy In 2021

Best Forex Stochastic Oscillator Strategy In 2021

Swing Trading with Stochastic Oscillator and Candlestick

Best Stochastic Oscillator Settings You Can Follow

Best Stochastic Oscillator Settings You Can Follow

Stochastic Settings For Daily Chart Forex drureport343

Stochastic Settings For Daily Chart Forex drureport343

Understanding Stochastic Oscillator Indicator Online Trading

Forex Trend Stochastic Oscillator MT4 Trading System [9642

Forex Trend Stochastic Oscillator MT4 Trading System [9642

Swing Trading with Stochastic Oscillator and Candlestick

Intraday Stochastic Trading System for Amibroker (AFL

:max_bytes(150000):strip_icc()/dotdash_Final_Pick_The_Right_Settings_On_Your_Stochastic_Oscillator_SPY_AAL_Jun_2020-02-ca0b9c6b7ec24f0caea83c7639191f94.jpg) Pick The Right Settings On Your Stochastic Oscillator (SPY

Pick The Right Settings On Your Stochastic Oscillator (SPY

Stochastic Oscillator Forex trading strategy — it's an

Stochastic Oscillator Forex trading strategy — it's an

Slow stochastic settings forex Stochastic Oscillator In

A Complete Guide on Stochastic Oscillator Indicator in

A Complete Guide on Stochastic Oscillator Indicator in

Stochastic Oscillator Ultimate Guide to Reading & Using

Stochastic Oscillator Ultimate Guide to Reading & Using

Comments

Post a Comment